Car depreciation calculator tax

- Diminished Value Claim. Ad Receive Pricing Updates Shopping Tips More.

Depreciation Calculator Depreciation Of An Asset Car Property

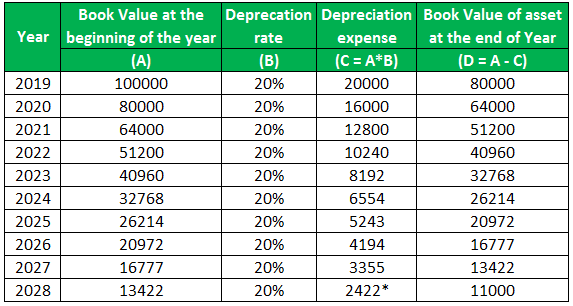

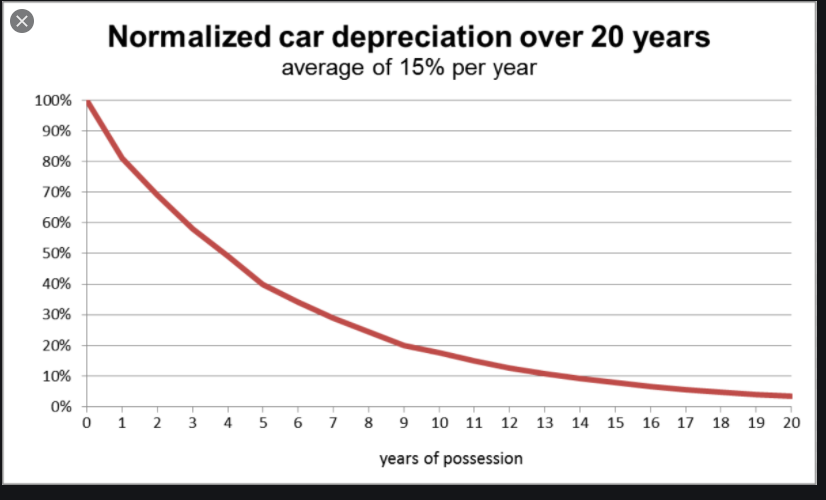

The depreciation is calculated by applying the vehicles depreciation rate average high or low and then adding the number of years you anticipate owning the vehicle.

. Double declining balance is the most widely used declining balance depreciation method which has a depreciation rate that is twice. When its time to file your. This calculator helps you to calculate the deduction you can claim for work-related car expenses for eligible vehicles.

The recovery period of property is the number of years over which you recover its cost or other basis. R i is the. Just subtract your cars present fair market value from the purchase price sales.

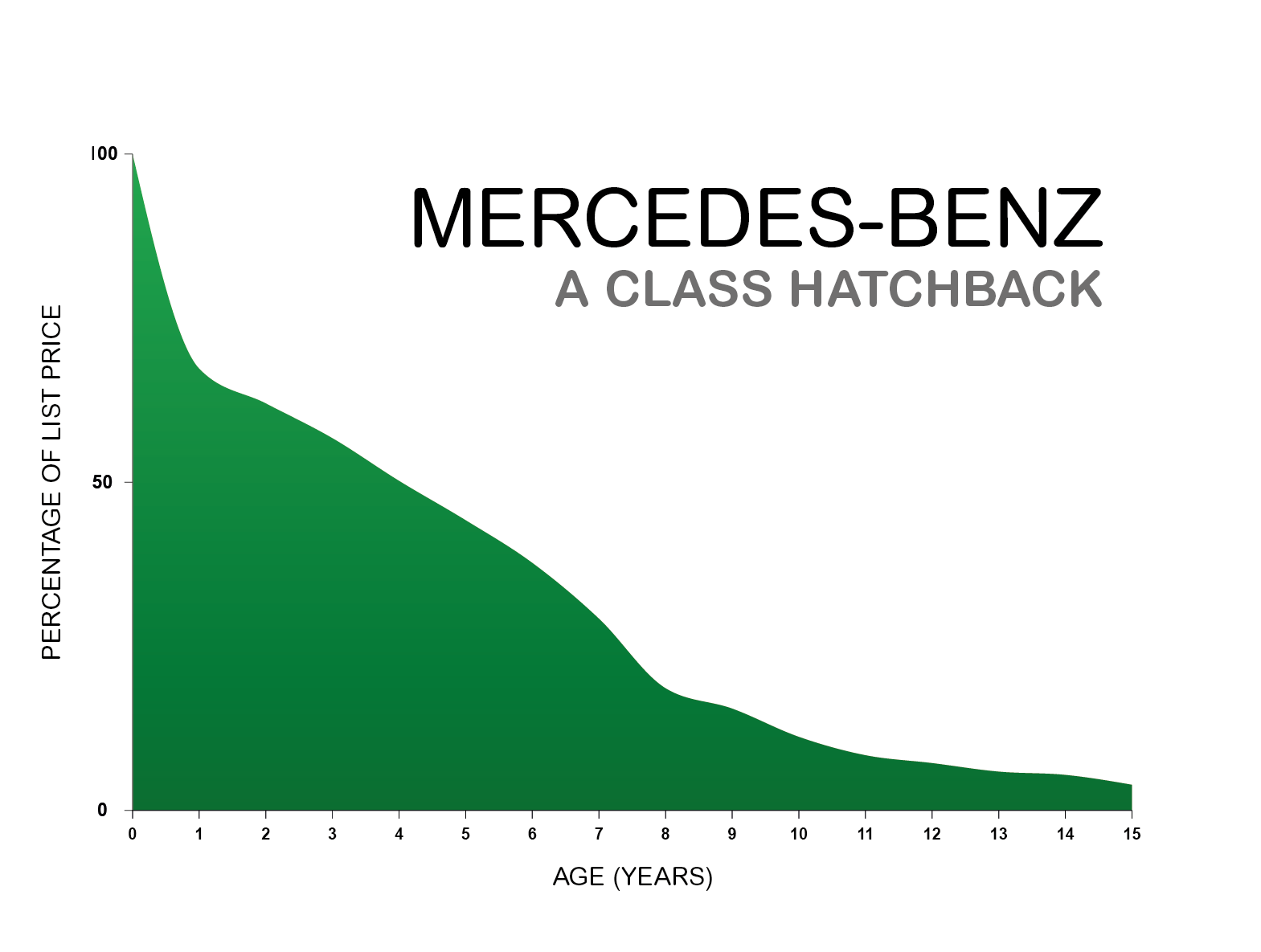

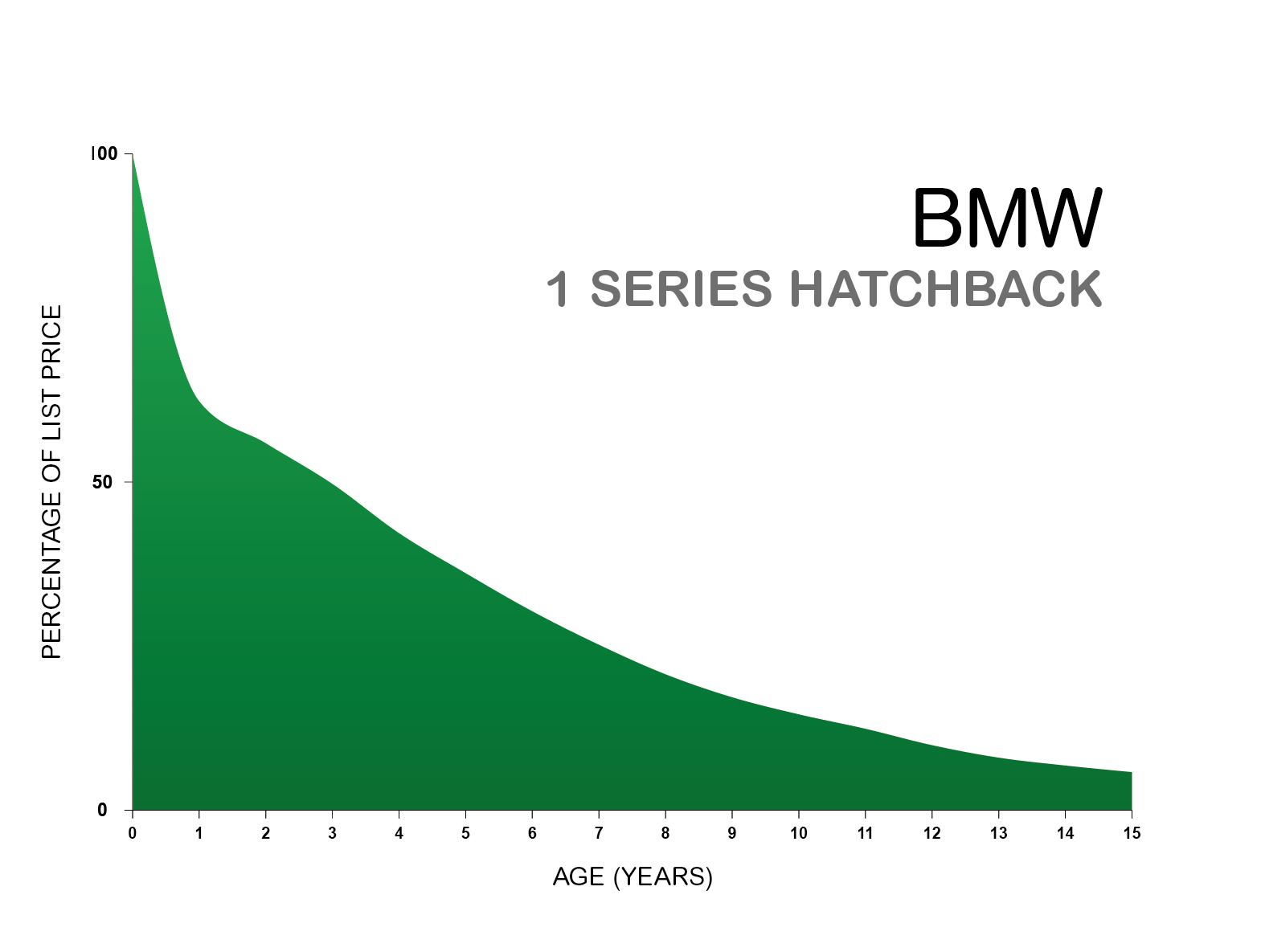

Our Car Depreciation Calculator below will allow you to see the expected resale value of over 300 models for the next decade. Before you use this tool. This includes a Nissan Titan and NV Cargo.

Car Appraiser - Free Consultation -Available Weekends - Call Now. Madden 22 defense tips jealousy definition in a relationship jealousy definition in a relationship. Section 179 deduction dollar limits.

A P 1 - R100 n. Work-related car expenses calculator. Depreciation per year Book value Depreciation rate.

The Good Calculators Depreciation Calculators are specially programmed so that they can be used on a variety of browsers as well as mobile and tablet devices. It is determined based on the depreciation system GDS or ADS used. In 2021 and under IRC 168 k your business may have qualified for a federal.

Edmunds True Cost to Own TCO takes depreciation. It can be used for the 201314 to. D P - A.

Know Your Payment Options While You Shop With No Hit To Your Credit Score. This tool is available to work out the depreciation of capital allowance and capital works for both individual and businesses taxpayers. Ad Calculate Your Monthly Car Loan Payments With Tax And See Which Cars Fit Your Budget.

To calculate the depreciation of your car you can use two different types of formulas. 18100 First-Year Depreciation for Qualifying Models. This limit is reduced by the amount by which the cost of.

Prime Cost Method for Calculating Car Depreciation. Where A is the value of the car after n years D is the depreciation amount P is the purchase. Calculate the cost of owning a car new or used vehicle over the next 5 years.

1 Credit and collateral subject to approval. The Car Depreciation Calculator uses the following formulae. We base our estimate on the first 3 year.

Diminishing Value and Prime Cost. So 11400 5 2280 annually. This calculator may be.

Using a 75000 equipment cost for a sample calculation shows how taking advantage of the Section 179 Deduction can significantly. Homes for sale mt shasta. Where D i is the depreciation in year i.

Both calculation methods contain. Loan must be open for at least 60 days with. C is the original purchase price or basis of an asset.

Cost of Running the Car x Days you owned 365 x. How to Calculate Depreciation. Auto refinance loan must be at least 5000.

Car Depreciation Calculator. Existing Navy Federal loans are not eligible for this offer. Ad Lowball Insurance Offer for Totaled Car.

The tool includes updates to. Use our depreciation calculator to estimate the depreciation of a vehicle at any point of its lifetime. The formula for calculating vehicle depreciation is fairly simple.

For tax years beginning in 2021 the maximum section 179 expense deduction is 1050000. SLD is easy to calculate because it simply takes the depreciable basis and divides it evenly across the useful life. We will even custom tailor the results based upon just a few of.

The MACRS Depreciation Calculator uses the following basic formula. D i C R i. Example Calculation Using the Section 179 Calculator.

There are basically two choices of calculation method of depreciation of a motor vehicle for tax purposes. Loan interest taxes fees fuel maintenance and repairs.

Car Depreciation Calculator

Depreciation Calculator Definition Formula

Depreciation Of Vehicles Atotaxrates Info

New Higher Rate Of Depreciation On Motor Car

Free Macrs Depreciation Calculator For Excel

How Much Is Car Depreciation Per Year Quora

Depreciation Formula Calculate Depreciation Expense

Download Depreciation Calculator Excel Template Exceldatapro

.png)

Car Depreciation For Taxes The Ultimate Guide Keeper Tax

Car Depreciation Calculator Calculate Straightline Reducing Balance Automobile Depreciation Rates Vehicle Values

Depreciation Rate Formula Examples How To Calculate

Car Depreciation Rate And Idv Calculator Mintwise

Car Depreciation Explained With Charts Webuyanycar

Income Tax Considerations When Transferring Depreciable Farm Assets Ag Decision Maker

Depreciation Of Vehicles Atotaxrates Info

Car Depreciation What Is It And How To Minimise It

Car Depreciation Explained With Charts Webuyanycar